-

Key Takeaways

- Employing Indian FinTech developers results in a 60-70% cost savings compared to developers in the USA, while still achieving the same strong talent and quality standards.

- Time zone differences allow for round-the-clock development, fast bug fixing, and quicker product launch cycles.

- Indian developers have a strong understanding of financial regulations, blockchain technologies (including cryptocurrency APIs), AI/ML and security coding practices, which are essential for FinTech.

- India has a talent pool of 4.5 million developers which allows the ability to scale a team faster and adjust to changing project requirements.

- A savings of $420,000 per year, from offshore development, can be reinvested in marketing dollars, product features and growth of the company.

A Complete Guide to Hire Indian Developers for FinTech in 2025

For companies looking to hire Indian developers for FinTech, they will be able to save approximately 60-70% of their costs while accessing a developer pool of India’s 4.5 million developers experienced with financial regulations, AI, blockchain, and secure code development. Indian developers offer 24/7 development cycles due to time zone differences, which will result in faster product development and the ability to continue developing the project.

This comprehensive guide covers considerations for evaluating developers, engagement models, security considerations, and a cost breakdown for hiring developers annually based on experience ranging from $15,000-$100,000. Companies outsourcing to India allow startups to reinvest saved money into the marketing, features, or expansion of their business with high-quality results in FinTech.

Why Indian Developers Are in High Demand for FinTech?

The financial technology (FinTech) industry is rapidly evolving, creating a demand for proficient developers who can develop safe and unique FinTech software applications. India has emerged as the leading country to recruit talented developers. When you Hire Indian developers for FinTech software, you gain access to an abundant pool of developers who are familiar with sophisticated financial systems, processes, and security.

Indian developers have been part of successful FinTech projects around the world, creating applications. They understand how to develop mobile banking applications, digital payment applications, and investment applications. In fact, India produces over 1.5 million engineering graduates each year. This means when you hire Indian developers for FinTech, there is a seemingly endless pool of talent available for your FinTech software.

Growing Need for Cost-Effective FinTech Development

Both FinTech startups and established companies are looking for ways to balance cost and the quality of software development. The cost to develop financial software in-house is exorbitant. Hiring local developers in the US or Europe costs much more than working with a developer in India for U.S. startups. This cost-effective FinTech development allows companies to put more money into marketing, research, and general business development.

More consumers now use mobile banking, digital wallets, and online investment applications. Businesses now must create and update their FinTech software applications faster than ever before. Indian developers can help businesses achieve this goal.

Why Hire Indian Developers for FinTech?

Discover the compelling benefits of partnering with Indian developers for FinTech applications including specialized expertise, elite technical skills, competitive prices, and offshore development benefits for your business.

Benefits of Hiring Indian Developers

There are certain key advantages of working with Indian developers for FinTech projects, including:

| Benefit | Description |

|---|---|

| Large Talent Pool | India has over 4.5 million software developers |

| English Proficiency | Most developers speak excellent English |

| Technical Skills | Strong knowledge of programming languages and frameworks |

| Time Zone Advantage | Can provide 24/7 development support |

| Cost Savings | 60-70% less expensive than Western developers |

| Quality Work | High standards and attention to detail |

Expertise in FinTech App Development

When you look to hire Indian developers for FinTech, you need to check that they have strong experience in developing various types of financial applications. They should be experts in building:

- mobile banking applications

- digital payment systems

- cryptocurrency exchange applications

- insurance management applications

- loan processing software

- investment tracking applications

- robo-advisors

- regulation compliance applications

Many Indian developers have experience working with global banks and financial services institutions. They understand the complex requirements of developing financial software. This experience is invaluable to building financial applications that architects need for them to be secure and reliable, work as intended, and meet guidelines established internationally.

Also Read:

How to Hire AI Developers for Your Startup?Competitive Pricing and Offshore Advantage

The main advantage of offshore FinTech development is cost savings:

Cost Comparison by Developer Level:

| Developer Level | US Annual Cost | India Annual Cost | Cost Savings | Savings Percentage |

|---|---|---|---|---|

| Senior FinTech Developer | $120,000 | $25,000-$35,000 | $85,000-$95,000 | 71-79% |

| Mid-Level Developer | $90,000 | $20,000-$28,000 | $62,000-$70,000 | 69-78% |

| Junior Developer | $65,000 | $15,000-$22,000 | $43,000-$50,000 | 66-77% |

| Tech Lead | $150,000 | $35,000-$45,000 | $105,000-$115,000 | 70-77% |

Cost Comparison by Developer Level:

| Advantage | US Development | Indian Offshore Development | Business Impact |

|---|---|---|---|

| Working Hours | 8 hours/day | 16-24 hours/day (time zone advantage) | 2-3x faster development |

| Team Scaling | Limited local talent | Large talent pool available | Quick team expansion |

| Project Continuity | Work stops after hours | Round-the-clock development | Faster product launches |

| Bug Fixes | Next business day | Same day/overnight fixes | Improved customer satisfaction |

| Market Competition | Standard timeline | Accelerated delivery | Competitive advantage |

| Cost Flexibility | Fixed high costs | Variable cost structure | Better budget management |

Indian development teams also work in different time zones. This means that development work and projects can keep progressing while your internal teams are sleeping. This provides for quicker completion of projects and immediate bug fixing, quicker than your competitors. The ability to deliver applications more quickly than competitors translates into faster market entry and higher customer satisfaction.

Key Skills to Look for in Indian FinTech Developers

Understand the technical competencies and specialized knowledge areas that will be most important when investigating Indian developers, including regulatory compliance, new technology experience, security expertise, and integration as keys to your FinTech project success.

Knowledge of Banking & Financial Regulations

Great FinTech programmers should have an understanding of financial regulations and regulations. They should be knowledgeable on:

- PCI DSS compliance around payment processing

- GDPR & data protection regulations

- KYC rules & guidelines

- AML regulations

- SOX regulations for financial reports

- Open Banking guidelines

- Basel III banking regulations

Typically, Indian programmers working on FinTech projects have this knowledge. The programmer can develop a system that is compliant with these laws and regulations, allowing projects to avoid regulatory issues and enabling the app to work in multiple countries.

Experience with Blockchain, AI & ML in Finance

Today, FinTech app developers India are typically more advanced, use modern technologies, and have value propositions that are developments of existing business models. Developers who are proficient in FinTech projects often have experience or training with:

Blockchain Technology:

- Smart contracts

- cryptocurrency

- DeFi (Decentralized Finance)

- NFT marketplaces

- Blockchain security

Artificial Intelligence:

- AI Chatbot Development services for customer support.

- Fraud detection algorithms

- AI for risk assessment

- Generative AI Development services for personalized finance (and any data)

- AI agent for trading.

Machine Learning:

- Machine Learning Development services for credit scoring

- Predictive analytics for investments

- Computer vision development services for document verification

- Natural language processing for financial analysis

Proficiency in Secure FinTech Software Development

The security aspect is the most critical part of the FinTech-development process, and developers need to understand:

- Means of encryption (AES, RSA, SSL/TLS)

- Secure coding practices

- Penetration testing

- Security audits

- Multi-factor authentication

- Biometric authentication

- Secure API development

- Data masking, tokenization

Indian FinTech developers possess high-level security skills. They understand how to secure sensitive financial information and prevent cyberattacks, which is important for building trust with financial applications.

Familiarity with APIs & Payment Gateways

FinTech applications will frequently require connections to a number of third-party services that developers will likely need some level of experience with or be comfortable exploring. This could include:

- Integrating a third-party payment processor such as Stripe, PayPal, Razorpay

- Integrating banking APIs

- Integrating currency exchange APIs

- Integrating credit scoring APIs

- Integrating KYC verification systems

- Integrating SMS and email notification APIs

- Integrating cloud services (AWS, Azure, Google Cloud)

Looking to scale your FinTech project affordably without compromising quality?

Partner with India’s top FinTech developers and get your product to market faster.

Outsourcing vs In-House: What Works Best for FinTech Startups in the U.S.?

Investigate strategic advantages to offshore vs in-house, factoring in costs, talent availability, scalability, and determine how Indian developers serve U.S. start-ups as cost-effective engineers to deliver their FinTech goals.

Advantages of Offshore FinTech Development

FinTech software development outsourcing offers several benefits:

| In-House Development | Offshore Development |

|---|---|

| High salary costs ($100K+ per developer) | Lower costs (60-70% savings) |

| Limited talent pool | Access to global talent |

| Long hiring process | Faster team setup |

| High infrastructure costs | No infrastructure investment needed |

| Fixed team size | Scalable team size |

| Single time zone work | 24/7 development cycle |

Cost-Effective FinTech Development Through Outsourcing

Outsourcing has enabled startups to manage their budgets more expertly. Instead of $500,000 for five developers in the US, you could acquire a similar five-person team in India for approximately $150,000. That is a $350,000 reduction that can be moved towards:

- Recognizing alternative funds for marketing or customer acquisition.

- Adding additional features or functionality.

- Security audits and compliance if needed.

- Adjust to business expansion.

- Set rates for emergency costs for unexpected changes.

How Indian Developers Support U.S. Startups?

A good understanding of the US market. They are familiar with many American firms and their needs as a business. They can:

- Build systems around the regulatory and legal requirements in the US to meet those needs (financial, etc).

- Build user interfaces the way American customers prefer.

- Use common American payment platforms (Square, PayPal, Zelle, etc.).

- Be responsive during US business hours.

- Engage with US business norms about styles of communications.

Also Read:

Hire dedicated software developers in IndiaHow to Hire Indian Developers for FinTech Projects

Learn to prepare and follow a complete mathematical approach for determining which Indian developers for FinTech you will identify, assess, and bring on board from requirements, assessments, and regulatory compliance.

Define Your FinTech Project Requirements

Before hiring Indian developers for U.S. startups, you will have to define your project objectives as clearly as you can.

Technical Requirements:

- programming languages (Java, Python, JavaScript, etc.)

- Database (SQL, NoSQL)

- Cloud platform (AWS, Azure, GCP)

- Mobile (iOS, Android, both)

- Integration (APIs, third party)

Business Requirements:

- Target audience and market

- Main features and functionality

- Compliance

- Timeline and milestones

- Budget

- Scalability

Evaluate Developer Portfolios & Case Studies

When looking at potential developers or a development company or while you Hire Indian developers for FinTech, determine if their experience includes:

- Similar projects in the FinTech space in their development portfolio

- Client reviews and testimonials

- Case studies with measurable feedback on the projects

- Any awards or recognitions

- Technical certifications (or endorsements)

- Years of experience with FinTech projects

Request case studies on the work the developers have done, describing how the developers solved problems that were agreed upon with clients and customers. Hire Indian developers for FinTech who will comfortably share/share their success stories with potential clients.

Conduct Technical & Regulatory Knowledge Assessments

Assessing your candidates on technical capabilities, and their regulatory knowledge:

Technical Assessment:

Ask candidates to demonstrate their ability in these areas:

- coding tests in relevant programming languages and depending on expertise level.

- system design questions to build a scalable system architecture.

- database design and/or optimization.

- security, data breach or data protection implementation questions.

- API development or integration projects with third party systems.

Regulatory Knowledge Assessment:

Relation to finance-related regulatory processes:

- PCI DSS compliance general understanding.

- audits or data protection policies.

- Experience with financial regulations.

- understanding of risk management.

- audit and reporting requirements with a service or co-located architecture.

Ensure Strong Security & Compliance Skills

Security is important at a FinTech company. Evaluate your candidates on:

- Experience with any security, testing, or frameworks.

- Understanding of security threats.

- Knowledge or experience with encryption or data loss prevention.

- Experience with audits.

- Compliance to regulations.

Where to Find FinTech App Developers in India

Consider the following resources:

- Professional Development companies.

- Freelance platforms such as Upwork, Toptal, Freelancer, etc., work with various freelancers at a variety of levels & experiences.

- LinkedIn & other good community or professional networks.

- Technical Conferences.

- Referrals from other companies.

- Universities and institutions of higher learning.

- Development agencies and consultancies.

Hire developers who understand AI, blockchain, and security protocols essential for modern financial applications.

Choosing the Right FinTech Development Company in India

Learn to navigate assessment, engagement and collaborating with Indian partner software development firms for your FinTech projects while ensuring successful outcomes.

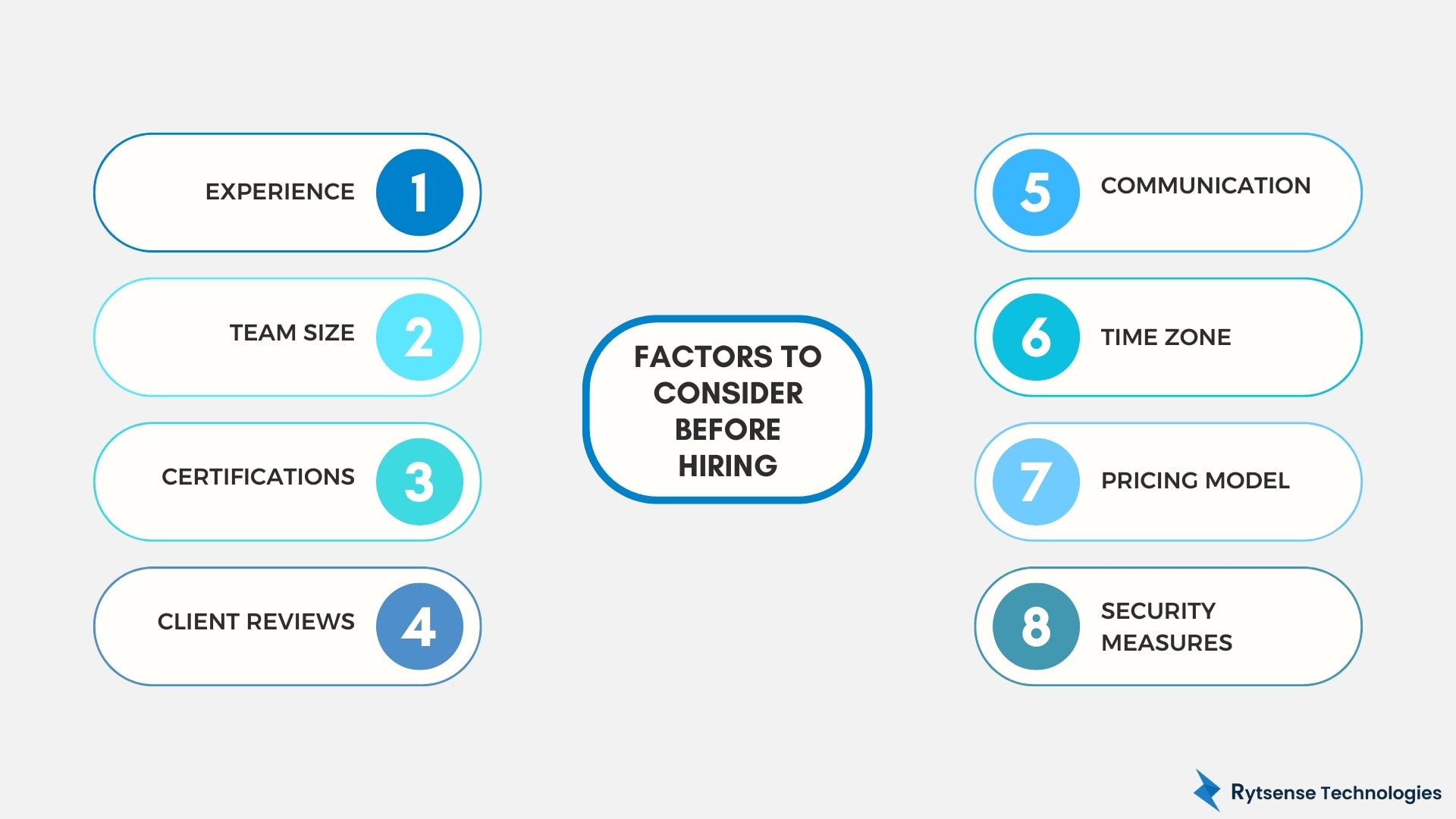

Factors to Consider Before Hiring

When selecting a FinTech development company India, consider:

| Factor | What to Look For |

|---|---|

| Experience | 5+ years in FinTech development |

| Team Size | At least 50+ developers |

| Certifications | ISO, CMMI, and security certifications |

| Client Reviews | Positive feedback from previous clients |

| Strong English communication skills | Communication |

| Time Zone | Overlap with your working hours |

| Pricing Model | Transparent and competitive pricing |

| Security Measures | Robust data protection policies |

Top Engagement Models for FinTech Software Development Outsourcing

Select an Engagement Model by your requirement:

Fixed Price Model:

- Best suited for well-defined projects

- Defined Scope and Timeline

- No potential for budget overage

- Lower risk for clients

Time & Material Model:

- Good option for projects with changing requirements

- Less defined scope and timeline

- Pay by actual work done

- More control over the development process

Dedicated Team Model:

- Best suited for longer-term projects

- Full control of the team

- Ability to scale the team size

- Cost savings vs having internal teams on large projects

Partnering With Dedicated Offshore Development Teams

The Dedicated Team works on your assignment as its sole focus. There are many potential benefits of a Dedicated Team, including:

- Clients gain understanding of their business more quickly

- More consistency within the team

- Improved communication; established rituals, methods and tools

- More productive & higher quality deliverables

- Building long-term relationships and avoiding hassles of new teammates and building rapport

- Strategic knowledge retention; team members become 'experts' in your firm

Challenges and Solutions in Hiring Indian Developers

Ways to unblock common topics in offshore FinTech partner collaboration such as time difference, security of data shareable, and overcoming communication to ensure long-term success as part of your development team.

Overcoming Time Zone Differences

There are challenges but it can be managed:

Challenges:

- Delay in communications

- Met results to plan meetings

- Difficulties collaborating in real-time

- Complicating project management

Solutions:

- Plan for overlapping working hours

- Impose routine for communications

- Announce meetings in advance

- Allocate time at end of potential meetings for planning what to do/work on next

- Use project management software

- Establish clear communication protocols

Ensuring Data Security & Compliance

When working with offshore teams, data security is an important consideration:

Security Measures:

- Sign rigorous NDAs and security agreements

- Only obtain data from teammates authenticated through a VPN connection

- Implement role-based access measures

- Perform regular security audits & assessments

- Ensure repositories & development environments are secured

- Encrypt your data when in transit & at rest

Building Strong Communication & Collaboration

Effective communication is the most important factor in successful outsourcing:

Best Practices:

- Do regular video calls and meetings

- Have clear project documentation

- Utilize project management and task management tools

- Institute cultural sensitivity training

- Obtain regular feedback from and on performance

- Celebrate wins together in whatever way you can.

Cost of Hiring Indian Developers for FinTech in 2025

Familiarize yourself with the complete pricing environment for Indian FinTech developers, including a thorough cost comparison by experience level, differing pricing structures, and the tremendous ROI of tactical outsourcing for startups.

Breakdown of Pricing Models (Hourly, Monthly, Dedicated Team) (TAB)

Here are typical cost ranges for hiring Indian programmers:

| Developer Level | Hourly Rate | Monthly Rate | Annual Rate |

|---|---|---|---|

| Junior Developer | $8-15 | $1,200-2,500 | $15,000-25,000 |

| Mid-Level Developer | $15-25 | $2,500-4,000 | $25,000-40,000 |

| Senior Developer | $25-40 | $4,000-6,500 | $40,000-65,000 |

| Tech Lead | $35-50 | $5,500-8,000 | $55,000-80,000 |

| Solution Architect | $45-65 | $7,000-10,000 | $70,000-100,000 |

How Indian Developers Provide Cost-Effective FinTech Development

The cost advantage when you hire Indian developers for FinTech can be attributed to various factors:

- India's lower cost of living

- India's competitive developer market

- Government support of the IT industry

- Existing outsourcing infrastructure

- Development companies gain economies of scale

- Efficient development processes or methodologies

ROI of Hiring Indian Programmers for Startups

Startups can achieve large peace of mind or returns by Hire Indian developers for FinTech in India. A cost savings example is:

- US Development Team (5 programmers): $600,000 per year

- Indian Development Team (5 programmers): $180,000 per year

- Annual savings: $420,000

- 3 year savings $1,260,000

| Development Option | Annual Cost | 3-Year Cost | Savings vs US Team |

|---|---|---|---|

| US Development Team (5 developers) | $600,000 | $1,800,000 | - |

| Indian Development Team (5 developers) | $180,000 | $540,000 | $420,000/year |

| Total 3-Year Savings | $420,000 | $1,260,000 | 70% Cost Reduction |

Invest this saved money on:

- Marketing product and acquiring users

- Expand the product to include more features and improvements

- Expand the business to new markets

- Build customer support team(s)

- Research and development for future new products

Strategic Investment Opportunities with Saved Capital:

| Investment Area | Annual Budget Allocation | Expected ROI |

|---|---|---|

| Product Marketing & User Acquisition | $150,000 | 200-300% customer growth |

| Additional Features & Improvements | $100,000 | Enhanced user experience |

| Business Expansion (New Markets) | $80,000 | 40-60% revenue increase |

| Customer Support Team | $60,000 | Improved retention rates |

| Research & Development | $30,000 | Future product innovation |

| Total Strategic Investment | $420,000 | Comprehensive Business Growth |

Future of FinTech Software Development Outsourcing

Take a closer look at the new trends that are redefining FinTech development in India, including AI, blockchain, and cloud, and find out why offshore development will continue to expand across the world.

Emerging Trends in FinTech Development in India

Here are some trends changing the landscape for the future of FinTech developers:

Technology trends:

- More artificial intelligence and machine learning

- Blockchain for secure transactions

- Cloud-native application development

- Microservices architecture

- API-first development strategy

- Proliferation of low-code and no-code

Market trends:

- Growth in digital banking

- Expansion in cryptocurrency services

- Embedded finance model

- Financial inclusion

- Regulatory technology (RegTech)

- Sustainable and green finance applications

Role of AI, Blockchain, and Cloud in Future FinTech Apps

These technologies will continue to take on more important roles in FinTech:

Artificial Intelligence:

- Financial advice created for the user

- Automated/AI-based customer support

- Fraud detection and management

- Risk assessment and risk scoring

- Algorithmic trading

- Predictive analytics for investment

Blockchain Technology:

- Digital identity verification

- Cross border payments

- Solutions for trade finance

- Financing the supply chain

- Decentralized finance programs

- Central Bank Digital Currency (CBDCs)

Cloud Computing:

- Scalable infrastructure

- Cost-effective development solutions

- Access from anywhere in the world

- Enhanced security

- Real-time data processing

- Disaster recovery solutions

Also Read:

How to Hire Top Remote Developers in India?Why Offshore FinTech Development Will Keep Growing

Offshore FinTech development will continue to grow for the following reasons:

- Demand for digital financial services continue to be on the rise

- Need for cost-effective development solutions

- Lack of skilled developers in the Western countries

- Better tools for communications and collaboration

- Better methodologies for project management

- Increased trust in the capabilities of the offshore development

How RytSense Technologies Can Support You?

RytSense Technologies is a leading technology firm that specializes in FinTech development. Rytsense Technologies supports U.S. startups and enterprises in hiring Indian developers for FinTech through tailored engagement models and regulatory-compliant development practices.

Services provided:

- Custom FinTech Application Development: Create customized financial software solutions

- AI Chatbot Development Services: Create AI-based customer support system

- Generative AI Development Service: Develop AI-based financial apps.

- AI Agent Development Services: Build automated trading and advisory systems Machine

| Advantage | Details |

|---|---|

| Experience | 10+ years in FinTech development |

| Team Expertise | 200+ skilled developers and engineers |

| Security Focus | ISO 27001 certified security practices |

| Global Clients | Served 500+ clients worldwide |

| Technology Stack | Latest tools and frameworks |

| Compliance Knowledge | Deep understanding of financial regulations |

| 24/7 Support | Round-the-clock development and support |

Process of Engagement:

- Consultation: Initial consultation is provided at no cost to us; we meet with you to inquire about your objectives, strategies, and ideas.

- Developer Selection: We carefully evaluate and select developers before creating a plan to ensure compliance with your needs.

- Project Plan: We create a detailed map and timeline for the project. Before we begin, you will have a clear understanding of what to expect with regard to time and cost so no surprises will arise as we move ahead.

- Development: We use an Agile methodology and communicate updates following completion of planned process stages on a certain timeline.

- Testing: We conduct thorough testing and execute quality assurance.

- Deployment: We will ensure your deployment goes as smoothly as possible and we will have your go live support should you require it.

- Maintenance: We provide you ongoing support/maintenance if you choose with a very reasonable amount of committed hours per month if you prefer.

RytSense Technologies employs industry security and compliance best practices and we are experienced in working with start-ups and enterprise clients. Our developers are trained in up to date FinTech technology and regulatory compliance.

Conclusion

There is a clear reason to hire developer in India for FinTech projects in 2025. The bottomline is cost, skilled talent, and developers working in real time. Indian developers provide stronger technical expertise, regulatory knowledge, and experience with modern FinTech technology.

Once you find the right development partner, you can secure, scalable and innovative financial applications ahead. The key to success is to identify and properly scope your requirements, screen candidates carefully and, most importantly, establish strong communications. Where there is proper planning and execution, off-shore Fintech development can be a way to achieve your organization’s needs and capabilities while keeping budgets in check.

The opportunities for FinTech are exciting, due to innovative technologies like AI, blockchain and cloud technology. You can stay competitive in the marketplace with Engaged Pod Indian developers who can navigate these options to create a better client experience in financial services.

Whether you are a start-up entrepreneur making your first entry into the FinTech world or a large corporation expanding into the digital world, Engaged Pod India developers can contribute what some may call enhancements and others may call necessities. The combination of technical experience and ability to augment the cost of regulatory authorities means India is a great outcome for FinTech software development outsourcing.

Overcome outsourcing challenges easily with Rytsense Technologies’ transparent processes and secure collaboration tools.

Meet the Author

Karthikeyan

Co-Founder, Rytsense Technologies

Karthik is the Co-Founder of Rytsense Technologies, where he leads cutting-edge projects at the intersection of Data Science and Generative AI. With nearly a decade of hands-on experience in data-driven innovation, he has helped businesses unlock value from complex data through advanced analytics, machine learning, and AI-powered solutions. Currently, his focus is on building next-generation Generative AI applications that are reshaping the way enterprises operate and scale. When not architecting AI systems, Karthik explores the evolving future of technology,where creativity meets intelligence.